Selling software: the Dollar

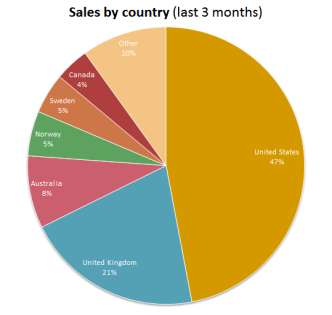

Although Octopus Deploy is an Australian business, most of our customers aren't. In fact Australian customers currently make up less than 10% of our sales. The United States is definitely the elephant in the room when it comes to software sales, an experience which I am sure is common throughout the software industry. In this post, I thought I'd share my experiences operating a small Australian business and dealing with foreign sales and the US dollar.

Background

As I mentioned in a previous post on selling software, our software is sold online through FastSpring, a US-based reseller. Customers follow a purchase link on our website, which takes them to a page that is hosted by FastSpring but styled to look like our site. There, they fill in their order details and make a payment, usually by credit card (though also through purchase orders and other payment methods). FastSpring figure out what taxes apply and also handle the fraud side. All up, FastSpring take about 6% of the sale for their trouble, and we take the rest.

Pricing

We fix our prices in US dollars on our website. I think this is important for four reasons:

- Most customers are from the US, so it makes it easy for them

- Everyone else usually knows the value of their own currency in USD

- Our competitors list their prices in USD, so it makes comparing easier (we don't compete on price, but it enables people to put us into the right "affordable/expensive" bucket in their heads)

- My US-layout keyboard doesn't have a £ or € keys, so it's more convenient to use $ (OK, maybe that's not an important reason)

When people visit the order page, FastSpring displays the prices in the user's local currency based on our USD price. We also set a fixed price in 5 other currencies (GBP, EUR, AUD, NZD, and CAD) not because we want to, but because it's required for FastSpring to accept bank transfers in those currencies as a payment method. I update those prices usually once a month or so and I try to ensure customers in non-USD aren't punished for it.

Getting paid in USD

FastSpring (and I'm sure other resellers) can pay us in multiple ways. We could choose to be paid in Australian dollars, but since the totals are calculated in US dollars, we'd be receiving an exchange rate at potentially a pretty bad time. Instead, I'd rather receive the funds in USD, and convert them when the rate is more favorable. To do this, we set up a USD denominated bank account with the Commonwealth Bank. Once a month, FastSpring sends a wire transfer to that account. They also charge us $15 to send that transfer (since their bank charges them $35).

Paying bills in USD

Although our bank allows us to hold funds in USD, we can't spend them easily - wire transfers are the only way to get funds out of that account. This is unfortunate because many of our bills are in US dollars, including Amazon EC2 and Windows Azure bills, along with much of the software we buy including JetBrains products, RavenDB licenses, and so on.

Previously I've been converting the US dollars to Australian dollars, and then paying the bills online through a Australian Mastercard which then applies another exchange rate to pay in USD. Of course the banks sting you both ways with punishing exchange rates, taking about 8% all up in the process.

However, I think I've found a better alternative. FastSpring can make deposits to a Payoneer debit card, which is USD denominated. I'll be trying this over the next few weeks and I'm hoping it will allow me to avoid the USD->AUD->USD round trip when paying our expenses.

Paying out in AUD

While the business is pretty virtual and our expenses are mostly online, I'm a real person and I need to pay for groceries in Australian dollars. So, at some point I need to convert the USD to Australian dollars as dividend payments.

This is unfortunate because the Australian dollar for the last year has been trading at record highs against the USD for some time (chart courtesy Yahoo):

(Speak to anyone in Australia this week of course and they'll blame the high Australian dollar for their woes. The local General Motors boss seemed to blame it as the cause for slashing 500 jobs, and even Australia's central bank can't make a profit because of the dollar. Our treasurer and shadow treasurer both seem to agree that the high AUD is a big problem. But, as it typical of Australian politics, aside from Bob Katter no one wants to actually do anything about it.)

Initially, I was using the Commonwealth Bank to convert the USD to AUD when I needed them. But they seem to take about three cents on top of the exchange rate in both directions, so they're taking a pretty steep cut. I've found much better rates through OzForex; for example, at the time of writing the CBA will give AUD $0.9234 for every USD $1, compared to OzForex giving AUD $0.9603.

GST

GST is a Australia's version of sales tax or VAT. Normally an Australian business would charge an additional 10% when selling to another Australian business or consumer, which goes to the Australian tax office every quarter. Like most sales taxes, it's designed so that the taxes you pay to other Australian businesses can be claimed as an offset, so that all you ever pay is 10%.

My business is interesting though, because we sell through a US-based reseller who is the merchant of record for the transaction. I can't charge them GST, and they can't charge Australian customers GST. But some of my expenses are local, which I do pay GST on. So every quarter, I file a business activity statement with a negative return to claim that back.

Summary and things I'd love to improve

I feel that running a small Australian-based business with customers overseas is hard. Our product is priced in USD, which means customers don't stop buying when the Australian dollar goes up (unlike other exporters who price in AUD). However we do have some costs in AUD, so the exchange rate can hurt. Finding ways to pay our overseas expenses without any currency conversion will hopefully help.

I think financial services in Australia could definitely do more to help small businesses and consumers deal with foreign currency. Foreign currency accounts shouldn't have so many fees (between account fees and transaction processing fees I'm paying about $70/month to the bank) and there should be ways to link them to debit cards so they can be used to pay for the kinds of expenses a small business has.